PatrickMcNally.com

Questions? Call or Text 530-319-5158

Retirement Lifestyles

Planning Bundle

Social Security - Medicare - Long Term Care

Budget - 11 Biggest Rollover Blunders

Each morning you'll receive an email with one of Patrick McNally's Retirement Planning Secrets... Apply each one and achieve Clarity, Confidence and Peace of Mind!

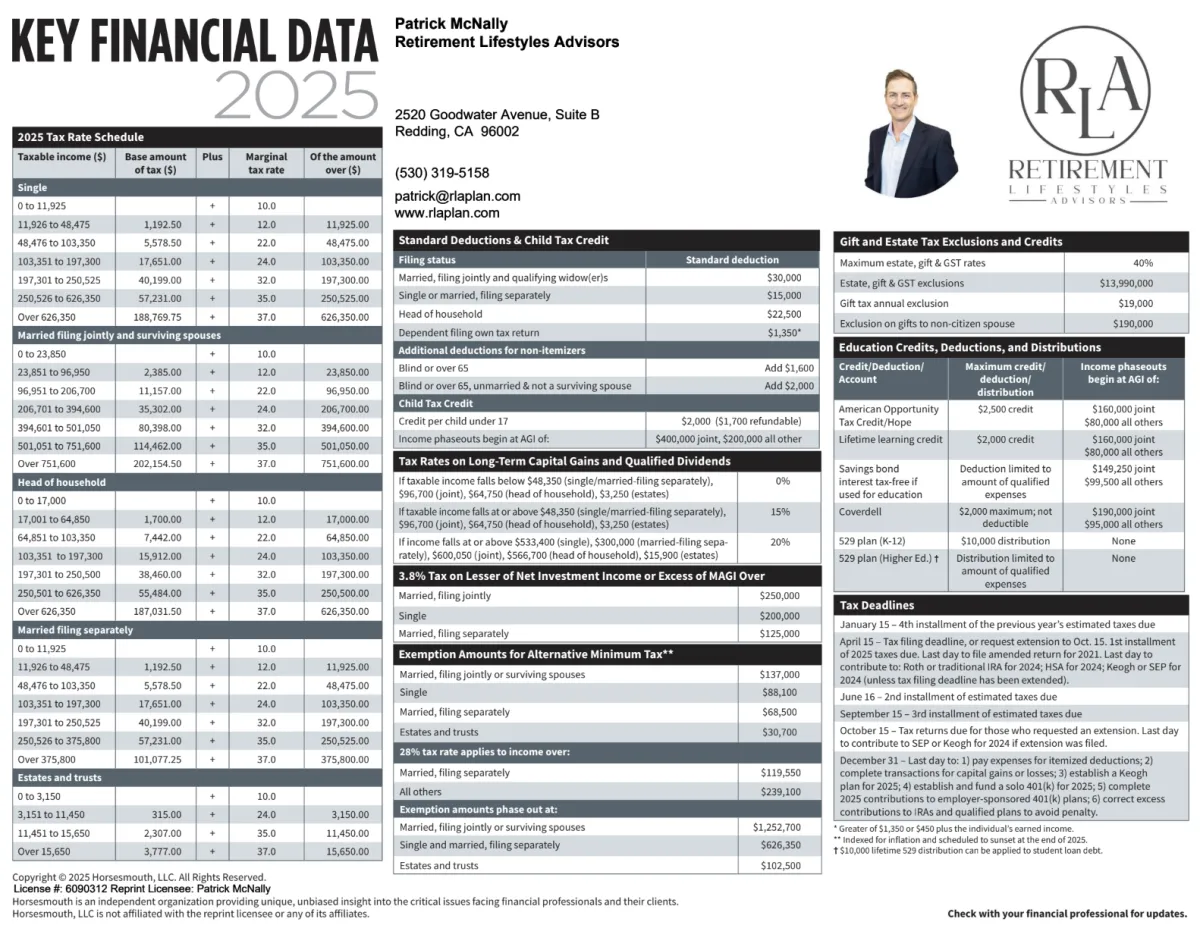

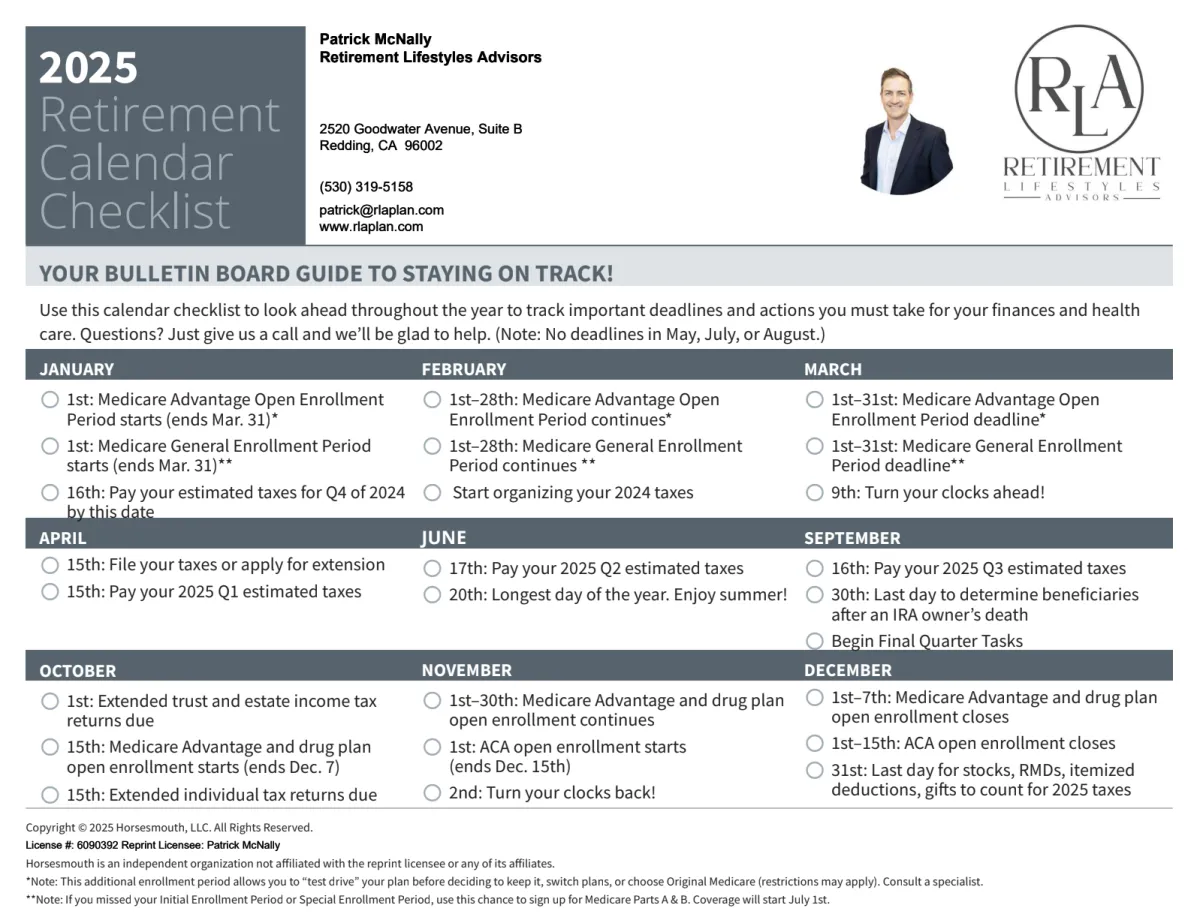

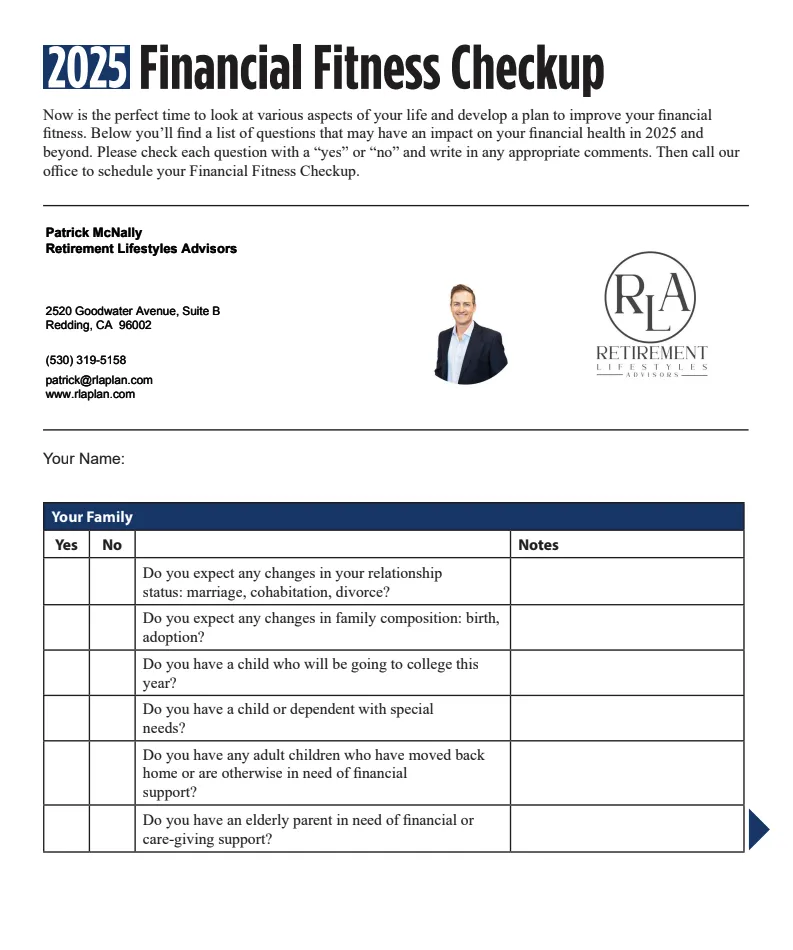

Extra Bonus's: Monthly updated planning checklists, quick guides and important retirement dates/deadlines for all areas of planning.

Social Security, Taxes, Estate, IRA’s, Long Term Care & More!

💥💥 NEW FOR 2025.!!!

CLICK the Picture and Download for FREE

2025 Financial Fitness

Radio Show

Each weekend, Patrick host’s “Retirement Lifestyles” Where it’s all about having the Health, Wealth, and Freedom you need, to live your dream retirement.

Join Patrick and his locally as well as nationally recognized guests, as they address the issues of importance for today’s retirees or soon-to-be retirees.

Book

There’s a million things you need to do to be prepared for Retirement…Review Social Security benefits, retirement savings accounts, health insurance, just to name a few. But

the number one thing Successful Retirees always plan for is…INCOME. Get your resource guide for this next stage of life.

Questions for Patrick?

Patrick McNally, Owner, Financial Advisor, Radio Host, Author

Starting out in financial services in 1999, I began my career working for my father in his insurance agency in San Diego, California. 5 years later he retired and I moved on to a large wealth management company where I quickly learned that the overall financial goals were more in line with the company than with the clients.

In 2010, I struck out on my own and founded McNally Wealth Management with the simple mission to provide Transparent , Independent financial advice that was simple to understand and free from conflicts of interest such as hidden expenses and high commissions.

A year later I was given the opportunity to start a Saturday morning radio show on News Talk 105.7 fm KQMS. I called it “ Retirement Lifestyles with Patrick McNally ”. Headed into our 13th year on the air, we are the number one financial radio show in the North State.

Our mission and our planning style became synonymous with the name Retirement Lifestyles, so we decided to change our firm name to match. Retirement Lifestyles Advisors was born.

Today, we are a thriving Registered Investment Advisory firm dedicated to a Fiduciary Standard of care.

We have an amazing family of clients that all share a common goal: Peace of Mind.

Enjoying retirement without worrying about the finances.

Learn More About Working With Us

Patrick Daniel McNally is a Registered Investment Advisor in the State of CA, DBA Retirement Lifestyles Advisory Group. CRD #154642. Ca Insurance License 0C76421

Past performance never guarantees future results. Inherent in any individual security, investment product or investment management program is the potential for profits as well as the risk of loss. No one can consistently predict, time or control market conditions or investment performance. Consult your financial advisor, tax advisor, attorney and other professional advisors before making any financial decision or taking any investment action. The information and web-site links we provide are strictly a courtesy. All interest rates or portfolio examples are for illustration purposes only. Individual results may vary. Advisory Services offered through Retirement Lifestyles Advisory Group, a CA State registered investment advisor. Securities and Brokerage services provided by The Charles Schwab Corporation. © 2025 Charles Schwab & Co., Inc. All rights reserved.

Copyright 2025. Retirement Lifestyles Advisors. All Rights Reserved.